Individuals

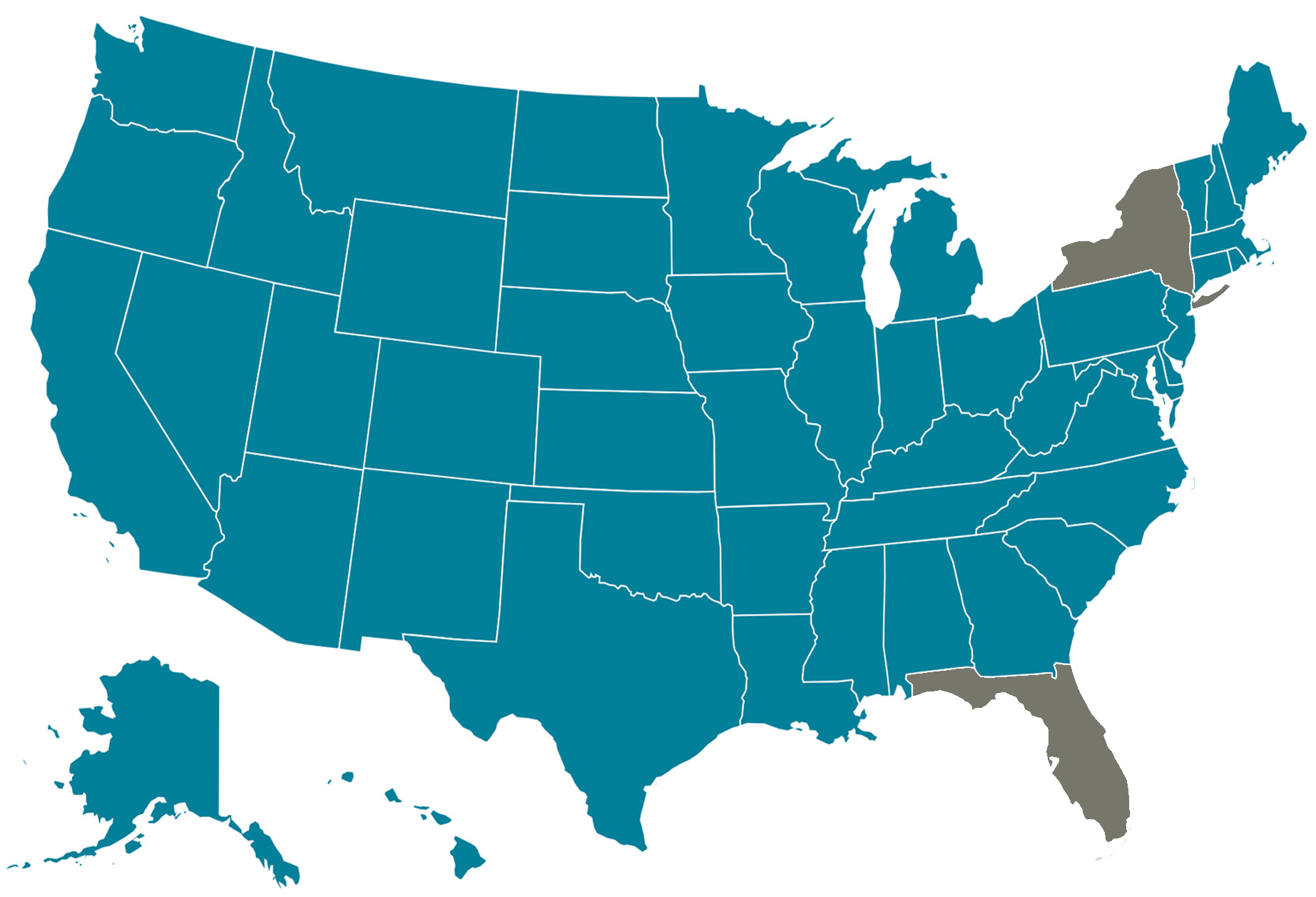

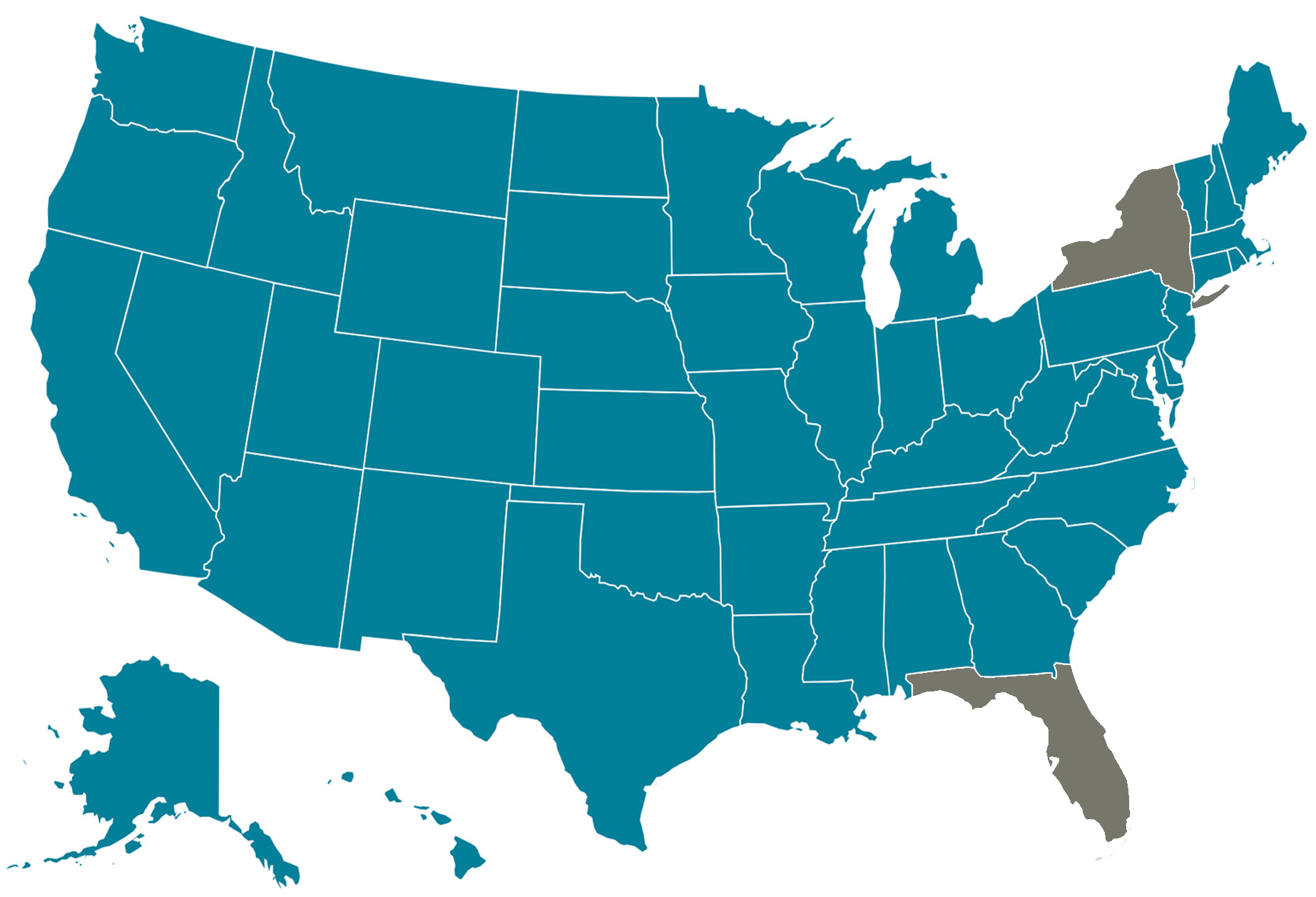

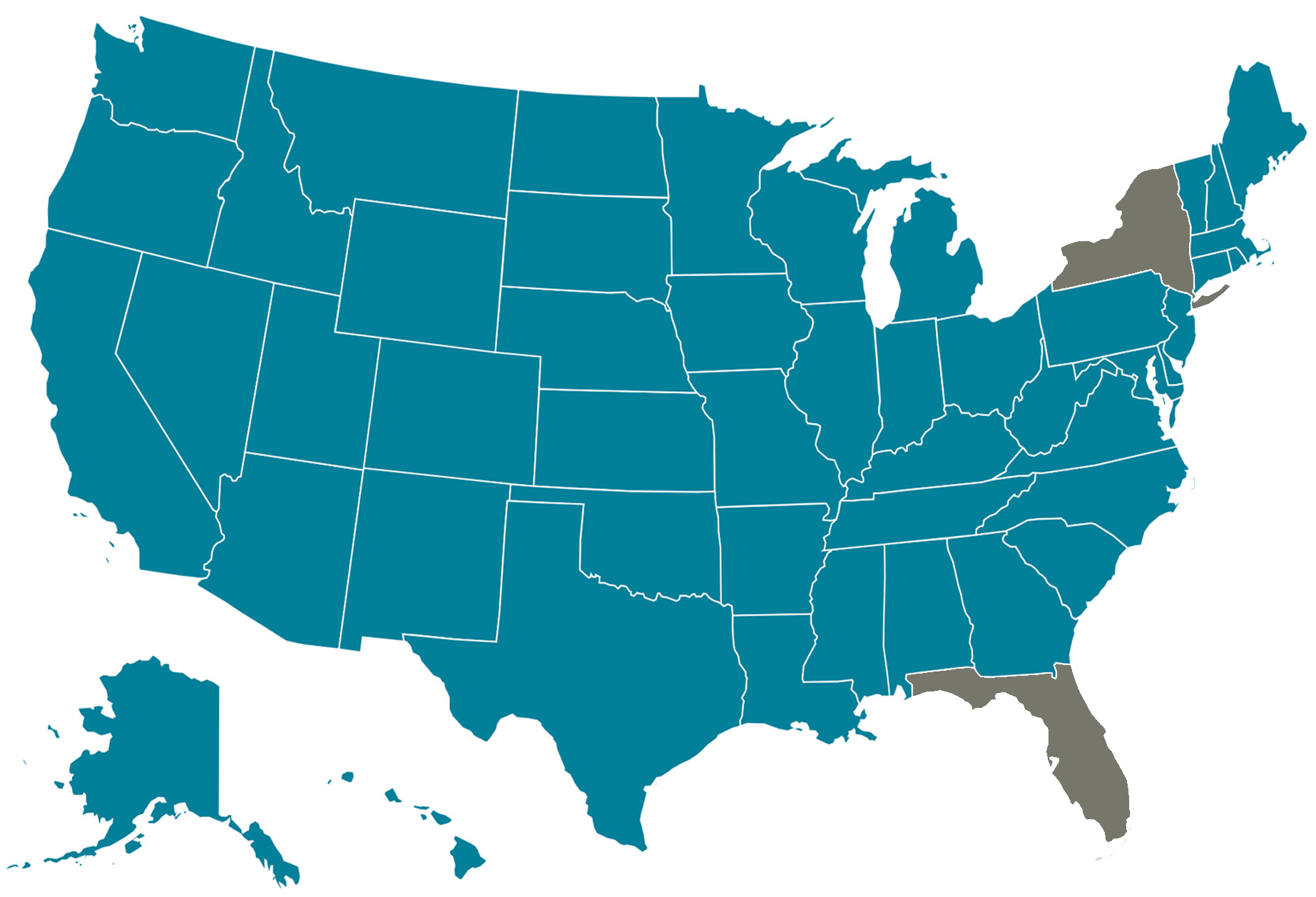

Select your state to view information for products in your area.

Products are available in DC and all states, except FL and NY.

LS-0407-D ST 04/23

LS-0407-D ST 04/23